Business & Law in Accounting & Taxation

What is it about?

In the Bachelor of Laws in Business & Law in Accounting and Taxation, you’ll immerse yourself in the world of business, including taxation, consulting, finance, and accounting. You’ll gain extensive knowledge of business administration and company law, giving you everything you need for an exciting career.

The goal? Equipping you for future leadership roles and preparing you for professional examinations as a taxation consultant or public accountant.

What can I do with it?

This degree opens doors to many exciting careers in accounting, auditing, and tax advice. The eight-semester degree length means graduates are eligible to take the taxation consultant examination after only two years of professional experience. The public accountant examination can be taken after three years in the workforce.

Graduates of business law programs are highly sought after in the employment market because they bridge the gap with those who have studied pure law and business degrees.

For degree-seeking students: detailed information on admission requirements, application deadlines, etc. can be found on the German page.

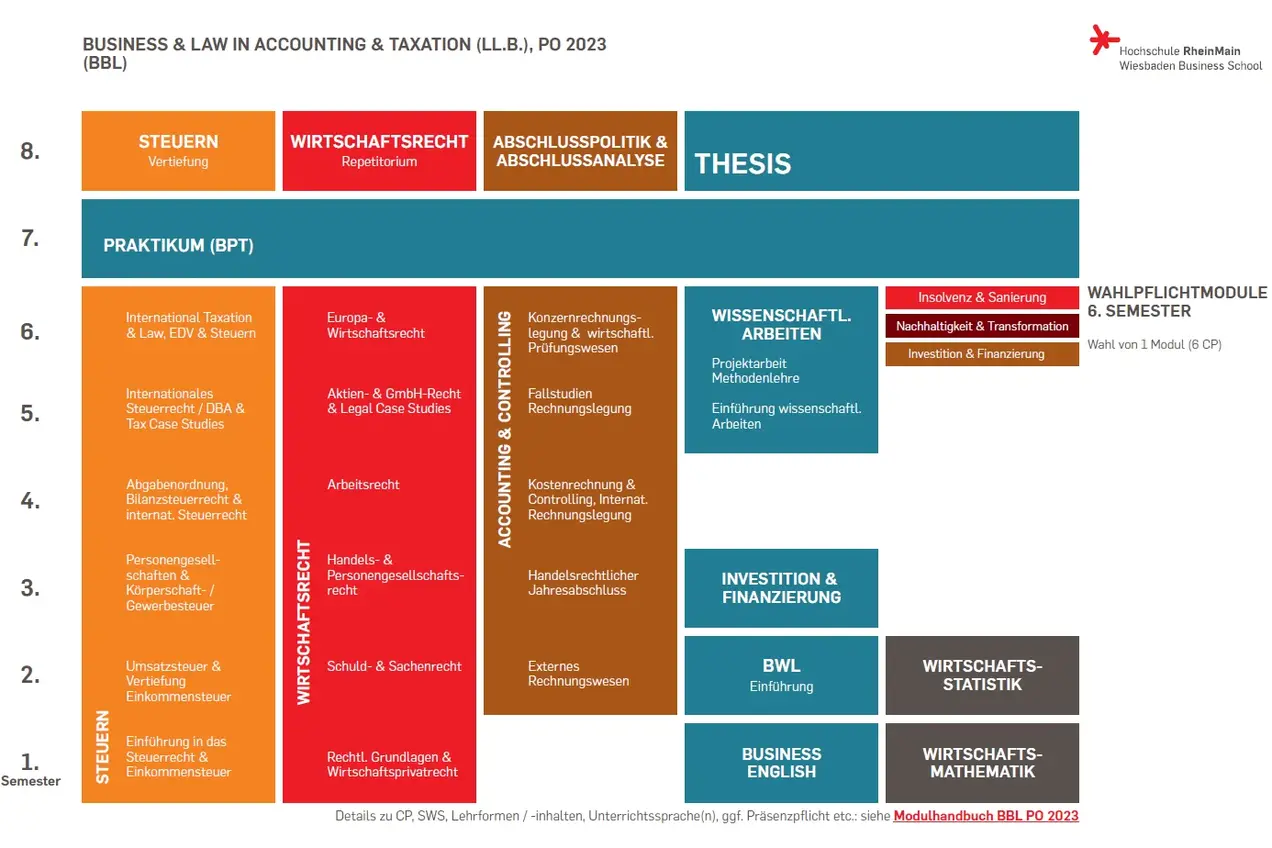

Structure of the studies

The study plan provides an overview of the content and specializations covered in each semester. More detailed information on the course content can be found in the module handbook and the curriculum .

Head of degree program

What our graduates say

I was able to gain valuable practical experience with my employer during my studies and was taken on as a consultant after graduation. After successfully passing the tax consultant exam, I am now starting my own business.